Resilience Testing for Financial Systems With Transaction Errors

Resilience Testing for Financial Systems With Transaction Errors is designed to simulate thousands of virtual users from over 26 cloud regions, ensuring that your financial systems remain reliable and recover quickly during transaction errors or failures. This template provides a step-by-step approach to identify weaknesses in your system's resilience, improve transaction success rates, and maintain high availability even during peak load.

What is Financial Systems Resilience Testing?

Financial Systems Resilience Testing focuses on simulating transaction errors and failures within a financial environment to evaluate how the system responds under stress. This template demonstrates how to use LoadFocus (LoadFocus Load Testing Service) to run resilience tests with thousands of virtual concurrent users from over 26 cloud regions. This ensures that your system is capable of handling transaction failures without significant disruptions, providing a better user experience and protecting your business operations.

This template helps you create, execute, and analyze resilience tests that highlight system weaknesses, allowing you to optimize your financial systems for reliability and performance under heavy traffic and transaction load.

How Does This Template Help?

The template offers structured steps to configure resilience tests for various financial transactions, focusing on handling transaction errors, recovery times, and system robustness. It provides best practices for identifying failure points and ensuring the system recovers swiftly while maintaining availability.

Why Do We Need Financial Systems Resilience Testing?

Without proper resilience testing, financial systems may experience significant issues such as data loss, transaction errors, or service downtime during high-demand periods. This template allows you to address these vulnerabilities, ensuring that your system can continue to function smoothly even during peak load or when transaction errors occur.

- Identify System Weaknesses: Discover points where transaction failures, network issues, or service dependencies can cause disruptions.

- Improve Transaction Recovery: Test how quickly your system recovers from transaction errors, minimizing the impact on your customers.

- Ensure High Availability: Ensure that your financial system remains operational and responsive, even under heavy load.

How Financial Systems Resilience Testing Works

This template focuses on simulating real-world errors in financial transactions, including network failures, server issues, or transaction timeouts. With LoadFocus tools, you can configure tests that simulate a variety of transaction errors, track recovery times, and monitor system health throughout the test.

The Basics of This Template

The template includes predefined scenarios, performance metrics, and monitoring strategies. LoadFocus integrates seamlessly to provide real-time insights, alerts, and dashboards that track the health and performance of your financial system during resilience tests.

Key Components

1. Scenario Design

Map out the different types of transactions and services involved in your financial system. Our template helps you configure scenarios that simulate various types of errors such as database timeouts, transaction rollbacks, or communication breakdowns.

2. Virtual User Simulation

The template allows you to simulate thousands of virtual users interacting with your financial system. LoadFocus enables you to scale your tests and replicate peak load conditions to assess system resilience during high transaction volumes.

3. Transaction Error Simulation

Learn how to simulate common transaction errors such as network disruptions, database failures, or timeouts. This helps test how well your system recovers from these types of failures and its ability to maintain transactional integrity.

4. Alerting and Notifications

Configure real-time alerts to receive notifications about any significant issues, such as increased error rates or slow recovery times, allowing you to respond quickly and take corrective actions.

5. Result Analysis

Once your tests are complete, the template provides a detailed approach to analyzing LoadFocus reports. It helps you pinpoint transaction errors, measure recovery times, and optimize system performance for resilience.

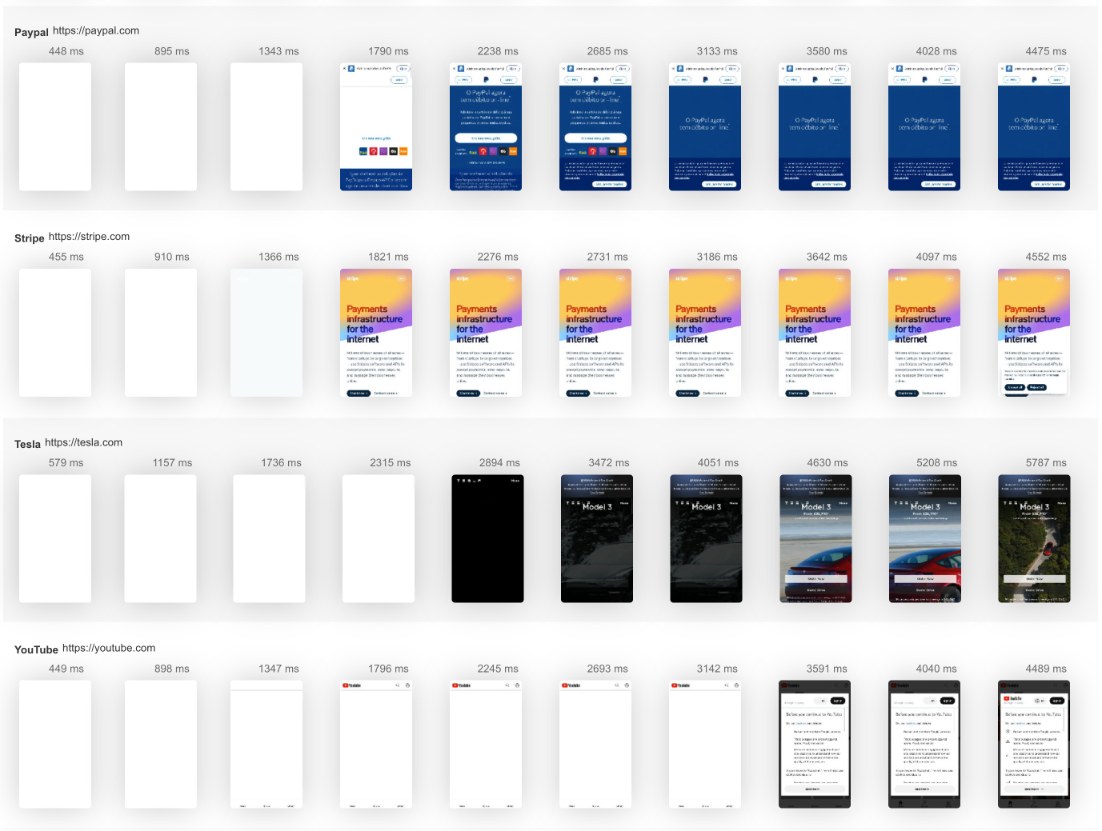

Visualizing Load Tests

Picture your financial systems under stress as transaction errors are simulated. The template shows how LoadFocus visualizations track error rates, system recovery, and transaction throughput to guide performance improvements and resilience enhancements.

What Types of Resilience Tests Are There?

This template covers different types of resilience testing to ensure your financial systems remain stable and recover quickly from transaction errors.

Stress Testing

Push your system beyond typical usage to identify failure points and test how the system manages transaction errors during extreme conditions.

Spike Testing

Simulate sudden bursts of user activity that may overwhelm the system and cause transaction failures. This helps ensure your system can handle spikes while maintaining resilience.

Endurance Testing

Simulate sustained heavy load for long periods of time to evaluate how well your system performs under continuous stress, and how it handles transaction errors during extended periods of high load.

Recovery Testing

Test the recovery process after transaction errors, such as database failures or timeouts. Measure how long it takes to recover and return to a stable state.

Volume Testing

Focus on handling large transaction volumes, ensuring that your financial systems can process a high number of transactions concurrently without significant delays or failures.

Resilience Testing Frameworks for Financial Systems

While you can use other frameworks such as JMeter or Gatling, LoadFocus excels in simplifying test creation and providing real-time insights that are essential when testing for resilience and transaction error handling.

Monitoring Your Resilience Tests

Real-time monitoring is crucial when running resilience tests. LoadFocus provides live dashboards that track error rates, recovery times, and transaction throughput as tests unfold, reducing the time needed to troubleshoot any issues.

The Importance of This Template for Your Financial System Performance

This template is critical for financial institutions or businesses relying on financial systems. It ensures your system’s resilience, minimizes downtime, and prevents transaction errors during peak times, ultimately enhancing the user experience.

Critical Metrics to Track

- Transaction Success Rate: Measure how many transactions complete successfully without errors.

- Recovery Time: Track how long it takes for the system to recover after a transaction error.

- Error Rate: Monitor the frequency of transaction failures or errors under load.

- Resource Utilization: Track system resources like CPU, memory, and I/O during load tests to ensure that they are not overwhelmed.

What Are Some Best Practices for This Template?

- Simulate Real-User Transactions: Test real-world financial transactions, such as transfers, withdrawals, or balance checks.

- Test for Multiple Error Types: Include common financial system errors like timeouts, database failures, and network disruptions in your test scenarios.

- Set Baseline Recovery Times: Establish target recovery times for your system and optimize based on test results.

- Automate Tests Regularly: Run resilience tests regularly to ensure your financial systems remain stable over time.

- Involve All Teams: Collaborate with IT, development, and operations teams to ensure full system coverage during resilience testing.

Benefits of Using This Template

Early Problem Detection

Identify system weaknesses and transaction error handling issues before they impact production systems.

Improved Transaction Integrity

Ensure that your system can handle transaction errors without affecting the consistency or integrity of the data.

Faster Recovery

Optimize the recovery process for quick restoration of services after a failure or error.

High System Availability

Ensure that your system remains available even during transaction errors or under heavy load.

Business Continuity

Maintain uninterrupted financial services, preventing revenue loss or customer dissatisfaction during peak periods.

Real-Time Alerts

Receive immediate notifications about system performance or transaction error spikes to address issues promptly.

Continuous Resilience Testing - The Ongoing Need

Financial systems evolve over time, with new services, transaction types, and integrations being added regularly. Continuous resilience testing ensures your systems remain capable of handling transaction errors and maintaining high availability, even as they grow.

Adapting to Changes

Regular resilience tests allow you to identify new error points as your system evolves.

Proactive Issue Resolution

Continuous testing helps uncover hidden issues before they cause real problems for users or customers.

Improved System Stability

Frequent testing helps ensure that your financial systems remain stable and resilient in all conditions.

Long-Term Performance Analysis

Track your system's resilience over time to assess improvements or regressions in handling transaction errors.

Fulfilling SLAs

Ensure that your financial systems meet performance and recovery SLAs during peak periods.

Streamlined Incident Response

Historical resilience test data provides insights for faster root cause analysis and quicker resolution of issues when they occur.

Ongoing Optimization

Constantly refine your financial systems to handle transaction errors and failures more efficiently, reducing recovery times.

Financial Systems Resilience Testing Use Cases

This template is ideal for financial institutions, payment gateways, or businesses relying on complex transaction systems.

Payment Gateways

- Transaction Failures: Ensure your payment system remains functional even during transaction failures or network disruptions.

- Recovery from Payment Timeouts: Test how your payment processing system recovers after network timeouts.

Banking Applications

- High Volume Transactions: Ensure that banking systems can handle high transaction volumes without data loss or errors.

- Transaction Rollbacks: Test the behavior of systems during transaction rollbacks and recovery.

Stock Trading Platforms

- Order Processing Failures: Simulate failure scenarios during order processing and ensure orders are not lost or corrupted.

- Resilience During Market Spikes: Validate system performance during peak trading hours.

Insurance Claims Systems

- Data Integrity: Ensure the integrity of insurance claims data when the system encounters errors.

- Service Availability: Ensure availability of insurance services even during transaction errors.

Common Challenges of Financial Systems Resilience Testing

Financial systems have unique challenges that must be addressed during resilience testing, including error handling, data consistency, and recovery times.

Transaction Integrity

- Ensuring Data Accuracy: Validating data consistency and ensuring that transaction errors do not corrupt records.

- Handling Rollbacks: Testing how well your system handles transaction rollbacks and restores accurate records.

Scalability

- High-Volume Transaction Handling: Ensuring your system can handle a surge of transactions without crashing or losing data.

- Peak Load Management: Validating your system’s ability to maintain performance during peak transaction times.

Security

- Protection of Sensitive Data: Ensuring that data is protected during transaction errors, especially in financial systems.

- Compliance with Regulatory Standards: Ensuring your system meets industry-specific standards during testing.

Cost Control

- Optimizing Test Frequency: Ensuring that resilience tests are run often enough to catch potential issues without exceeding budget.

- Resource Utilization: Avoiding overuse of resources while ensuring tests are thorough and comprehensive.

Test Accuracy

- Simulating Real-World Errors: Ensuring that simulated errors accurately reflect real-world issues in financial systems.

- Correct Error Handling: Ensuring that transaction errors are handled appropriately, with minimal impact on system integrity.

Data Management

- Maintaining Data Consistency: Ensuring that data remains consistent and accurate even when transaction errors occur.

- Log Management: Ensuring error logs and performance data are captured and analyzed accurately during tests.

Ways to Run Financial Systems Resilience Tests

The template illustrates different methods of running resilience tests, from simple error scenarios to more complex multi-step testing that simulates various failure conditions.

Synthetic Monitoring Meets Resilience Testing

Combine synthetic monitoring—such as pings or health checks—with full resilience tests to get a complete picture of how your financial system handles errors.

Getting Started with This Template

To use this resilience testing template effectively:

- Clone or Import the Template: Load the template into your LoadFocus project for easy setup and testing.

- Map Out Transaction Paths: Identify key financial transactions and configure tests to simulate errors during each step.

- Set Load Levels: Define traffic patterns and transaction volumes to replicate peak load conditions.

How to Set Up Financial Systems Resilience Testing

Use LoadFocus to configure resilience tests:

- Define Test Parameters: Choose cloud regions, error types, and virtual user counts.

- Simulate Transaction Errors: Set up error scenarios like database failures, timeouts, or network issues.

- Monitor in Real-Time: Use LoadFocus’s live dashboards to track recovery times, error rates, and transaction performance during testing.

Load Testing Integrations

Integrate your tests with collaboration tools like Slack or PagerDuty for streamlined communication and incident management during resilience testing.

Why Use LoadFocus with This Template?

LoadFocus simplifies the resilience testing process by providing:

- Multiple Cloud Regions: Test from over 26 regions to simulate global transaction failures.

- Scalability: Effortlessly scale virtual users to simulate transaction spikes and stress-test your systems.

- Comprehensive Analytics: Real-time dashboards and reports to analyze transaction errors and recovery.

- Easy CI/CD Integration: Automate testing and integrate it into your DevOps pipelines for continuous resilience validation.

Final Thoughts

This template is essential for testing the resilience of your financial systems and ensuring they can recover from transaction errors without significant downtime or data loss. By leveraging LoadFocus for resilience testing, you'll be able to optimize your systems for reliability and protect your business operations during high-traffic periods.

FAQ on Financial Systems Resilience Testing

What is the Goal of Financial Systems Resilience Testing?

The goal is to ensure your system can handle transaction errors without significant downtime or data corruption and recover quickly when issues occur.

How is This Template Different from General Load Testing?

This template specifically focuses on transaction error handling and system resilience during failure scenarios, ensuring business continuity under adverse conditions.

Can I Customize This Template for My Financial Services?

Yes. The template can be customized for different types of financial transactions, including payments, loans, and stock trading.

How Often Should I Run Financial Systems Resilience Tests?

It's recommended to run tests periodically, particularly before major system updates, during high traffic times, or when new features are implemented.

Do I Need a Dedicated Environment for Testing?

A pre-production environment is ideal, but testing can be performed in production during off-peak hours if necessary.

How Does Geo-Distributed Testing Help?

By testing from multiple cloud regions, you ensure your financial systems can handle global transaction failures and recover quickly across regions.

Do I Need Additional Tools?

This template, combined with LoadFocus, covers most resilience testing needs. You can integrate additional monitoring or APM tools for deeper insights if needed.

How fast is your website?

Elevate its speed and SEO seamlessly with our Free Speed Test.You deserve better testing services

Effortlessly load test websites, measure page speed, and monitor APIs with a single, cost-effective and user-friendly solution.Start for free→